Updated: January 18, 2025 | by Michael Thompson, Licensed Insurance Advisor & U.S. Army Veteran | Reading Time: 14 minutes

Quick Answer: Life insurance for retired military veterans includes several excellent options: VGLI (Veterans Group Life Insurance), VALife for disabled veterans, S-DVI (Service-Disabled Veterans Insurance), and private policies. According to the U.S. Department of Veterans Affairs, over 6 million veterans and service members currently hold VA life insurance. The best choice depends on your health status, disability rating, age, and financial goals. Most veterans benefit from combining VA programs with supplemental private coverage.

Why Life Insurance for Retired Military Veterans Matters: A Personal Story

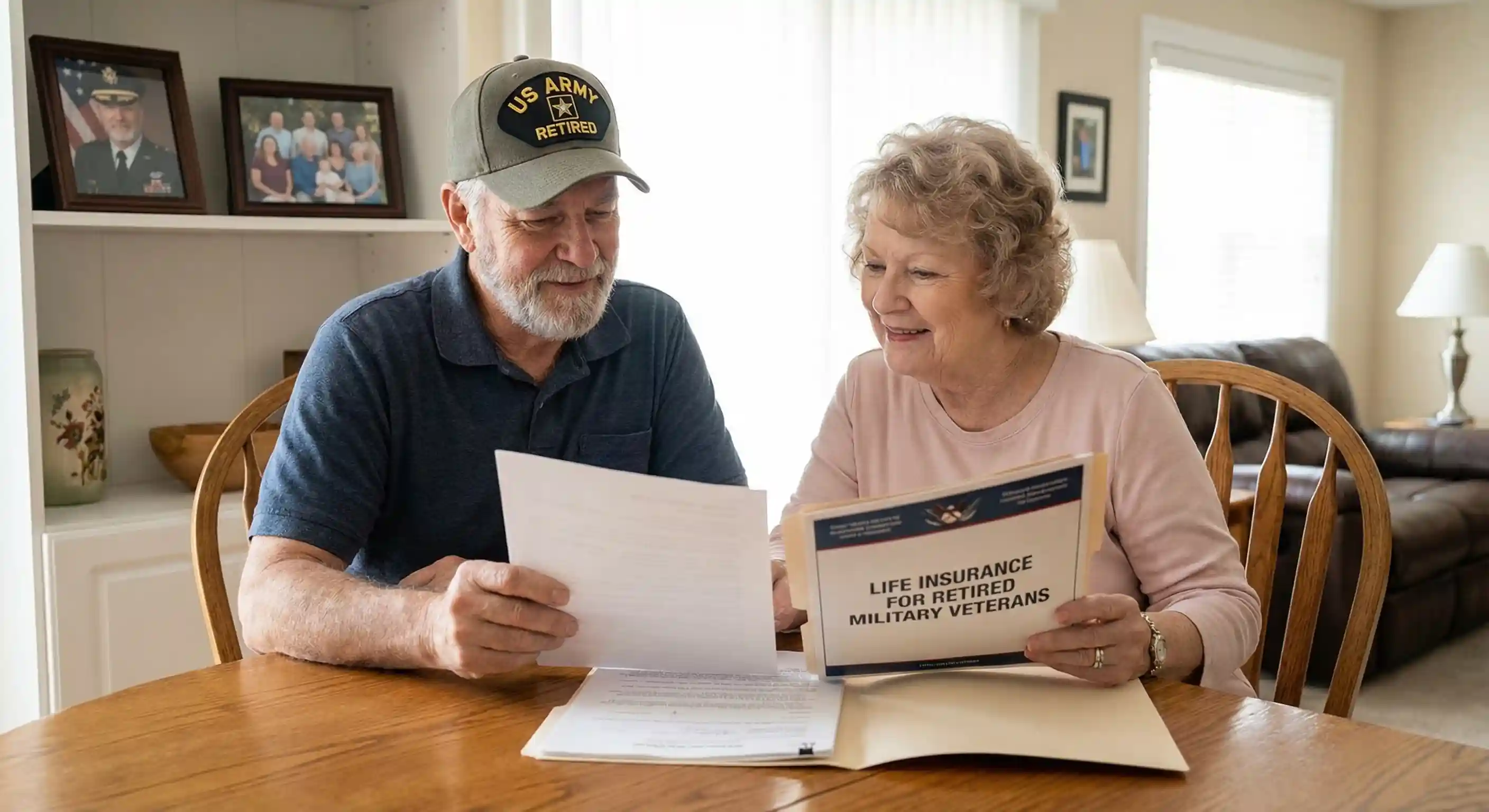

When I retired from the Army in 2018 after 22 years of service, I thought I had everything figured out. I had my pension, my Tricare, and a sense of accomplishment. What I didn’t have was a solid plan for life insurance. My SGLI was about to disappear, and honestly, I hadn’t given it much thought during those final months of clearing post at Fort Bragg.

Three months after retirement, my buddy Steve called me in a panic. He’d just realized his 240-day window for converting SGLI to VGLI without medical questions was closing in two weeks. Steve had developed Type 2 diabetes during his last deployment, and he was terrified no one would insure him. That phone call changed everything for both of us—and ultimately led me to become a licensed insurance advisor specializing in life insurance for retired military veterans.

I still remember sitting at the kitchen table with my wife, Sarah, that evening, going through all our paperwork. She looked at me and asked, “What happens to the kids if something happens to you?” That question hit harder than any combat training ever did. We had a mortgage, two kids heading toward college, and car payments. My military pension would be cut in half for Sarah through the Survivor Benefit Plan, but would that be enough?

That’s why I’m writing this guide. Too many veterans transition out of service without understanding their options. The Military.com benefits center reports that nearly 30% of eligible veterans miss critical deadlines for converting their military life insurance. I don’t want you to be part of that statistic.

For a broader understanding of insurance fundamentals, check out our comprehensive guide to term life insurance basics.

Understanding Life Insurance for Retired Military Veterans: Your Complete Options

Finding the right life insurance for retired military veterans can feel overwhelming. The good news? You have more options than most civilians, thanks to programs designed specifically for those who served. Let me break down each option so you can make an informed decision.

Life Insurance Options for Retired Military Veterans

- VGLI (Veterans Group Life Insurance): Convert your SGLI within 1 year and 120 days of separation

- VALife: New program for veterans with any service-connected disability rating

- S-DVI: Service-Disabled Veterans Life Insurance for those with VA disability ratings

- Private Term Life Insurance: Often more affordable for healthy veterans under 50

- Private Whole Life Insurance: Permanent coverage with cash value accumulation

- Final Expense/Burial Insurance: Smaller policies specifically for end-of-life costs

According to the VA Insurance Center, understanding these programs is crucial because each has specific eligibility windows and requirements. When I help veterans navigate life insurance for retired military veterans, I always start by assessing their unique situation—health status, family needs, budget, and timeline.

Last summer, I worked with a Marine Corps veteran named Rodriguez who had just hit his 55th birthday. He’d been putting off life insurance decisions for years, thinking he still had plenty of time. When we ran the numbers, we discovered that waiting just five more years would have nearly doubled his premium costs. That’s the reality of life insurance for retired military veterans—timing matters enormously.

For more details on permanent coverage options, read our article on whole life insurance explained.

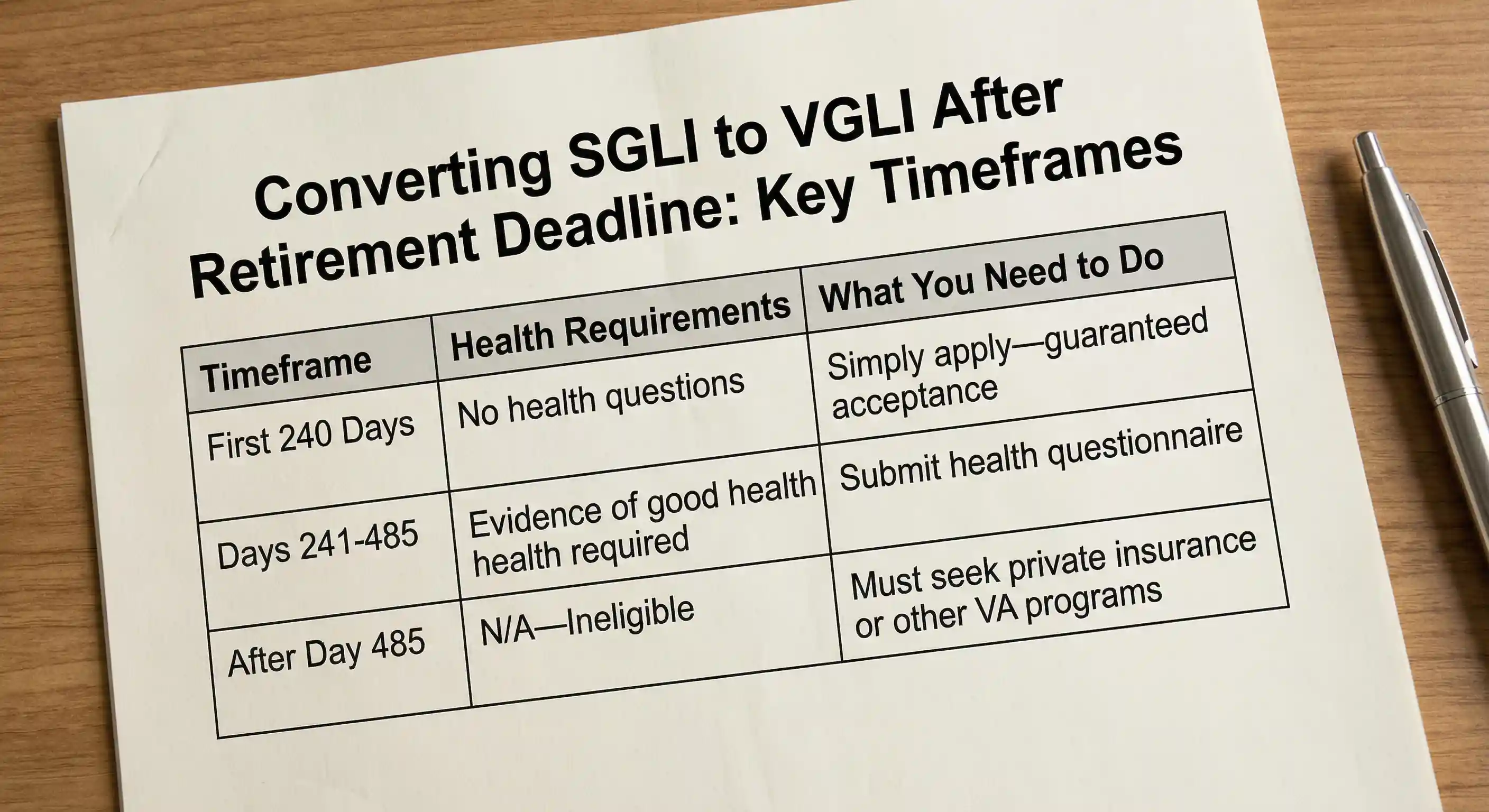

Converting SGLI to VGLI After Retirement Deadline: What Every Veteran Must Know

The process of converting SGLI to VGLI after retirement deadline is one of the most critical decisions you’ll make during your military transition. Miss this window, and you could lose access to guaranteed coverage forever—especially problematic if you’ve developed health issues during service.

Converting SGLI to VGLI After Retirement Deadline: Key Timeframes

| Timeframe | Health Requirements | What You Need to Do |

|---|---|---|

| First 240 Days | No health questions | Simply apply—guaranteed acceptance |

| Days 241-485 | Evidence of good health required | Submit health questionnaire |

| After Day 485 | N/A—Ineligible | Must seek private insurance or other VA programs |

Understanding the SGLI to VGLI Conversion Process

When converting SGLI to VGLI after retirement deadline considerations come up, I always tell veterans to act early. The VA’s official VGLI page makes the process straightforward, but procrastination is the enemy here.

I learned this lesson the hard way. After my retirement ceremony, I got caught up in job hunting, house hunting in Texas, and getting my kids enrolled in new schools. The VGLI paperwork sat in a folder on my desk for months. It wasn’t until day 180 that I finally submitted my application—cutting it uncomfortably close to that 240-day guaranteed acceptance window.

Critical Warning About Converting SGLI to VGLI After Retirement Deadline

- Your SGLI coverage ends 120 days after separation—you could have a coverage gap

- VGLI premiums increase every 5 years based on your age group

- Maximum VGLI coverage is $500,000 (matching your SGLI amount)

- There’s no cash value—this is pure term life insurance

- You cannot increase coverage after initial enrollment

The Prudential VGLI administration office handles all VGLI policies on behalf of the VA. They report that thousands of veterans miss the critical window each year simply because they didn’t know about the deadline. Don’t let this happen to you.

To understand your broader benefits picture, explore our article on military benefits after retirement.

VALife Insurance Rates for Disabled Veterans: The New Game-Changer

When VALife launched in January 2023, it revolutionized life insurance for retired military veterans with service-connected disabilities. Understanding VALife insurance rates for disabled veterans is essential because this program offers something unprecedented: guaranteed acceptance whole life insurance regardless of your health conditions.

VALife Insurance Rates for Disabled Veterans: Key Benefits

- Guaranteed acceptance: No medical exams or health questions

- Coverage up to $40,000: In $10,000 increments

- Whole life coverage: Builds cash value over time

- Premiums based on age only: Your disabilities don’t affect rates

- Available to any disability rating: Even 0% service-connected rating qualifies

- Two-year waiting period: Full benefits begin after 2 years (premiums refunded if death occurs earlier)

Understanding VALife Insurance Rates for Disabled Veterans by Age

According to the VA’s official VALife page, premiums are structured to be affordable at any age. Here’s a breakdown of what VALife insurance rates for disabled veterans actually look like:

Monthly Premium Examples for $40,000 Coverage

| Age at Enrollment | Monthly Premium (Approx.) | Annual Cost |

|---|---|---|

| 30-34 | $18-22 | $216-264 |

| 45-49 | $40-50 | $480-600 |

| 55-59 | $70-85 | $840-1,020 |

| 65-69 | $110-140 | $1,320-1,680 |

| 75-80 | $200-280 | $2,400-3,360 |

What makes VALife insurance rates for disabled veterans remarkable is what they don’t consider: your actual health conditions. When I met with Carlos, a Vietnam veteran with a 70% disability rating for PTSD and Agent Orange-related conditions, he’d been declined by three private insurers. VALife accepted him immediately at standard rates.

The AARP’s analysis of VALife confirms this program fills a crucial gap for veterans who previously had few options. It’s particularly valuable for life insurance for retired military veterans who developed conditions during or after service.

Learn more about disability-related coverage in our disability insurance guide for veterans.

Best Life Insurance for Veterans with Service-Connected Disability: Your Complete Guide

Finding the best life insurance for veterans with service-connected disability requires understanding how different insurers view military-related health conditions. This is where my years of experience helping fellow veterans really come into play.

I remember when my neighbor Tom, a Navy veteran with a 40% rating for hearing loss and tinnitus, assumed he couldn’t get affordable coverage. When we reviewed his options for life insurance for retired military veterans, we discovered his conditions barely affected his rates with veteran-friendly private insurers. Not all disabilities are treated equally by insurance companies.

Best Life Insurance for Veterans with Service-Connected Disability: Top Options

- VALife: Best for veterans with serious health conditions—guaranteed acceptance

- S-DVI (Service-Disabled Veterans Insurance): Up to $10,000 basic coverage plus supplemental

- VGLI: Good for those who enrolled during the guaranteed acceptance period

- USAA Life Insurance: Often offers competitive rates for military members and veterans

- Armed Forces Benefit Association: Designed specifically for military community

- Navy Mutual Aid Association: Available to all branches despite the name

How Insurers Evaluate Service-Connected Disabilities

When shopping for the best life insurance for veterans with service-connected disability, understanding how insurers categorize conditions helps you target the right companies. The Consumer Financial Protection Bureau recommends that veterans work with advisors who understand military-specific health issues.

How Common VA Disabilities Affect Life Insurance Rates

| Condition | Typical Impact on Private Insurance | Best Option |

|---|---|---|

| Hearing Loss/Tinnitus | Minimal to no impact | Private insurance likely cheaper |

| Controlled PTSD | Moderate—depends on treatment | Compare private and VA options |

| Musculoskeletal Issues | Low to moderate | Shop private insurers first |

| TBI (Traumatic Brain Injury) | High—often declined | VALife or S-DVI |

| Agent Orange Conditions | High—often declined or rated up | VALife or S-DVI |

For foundational knowledge on protecting your family financially, visit our comprehensive VA life insurance guide.

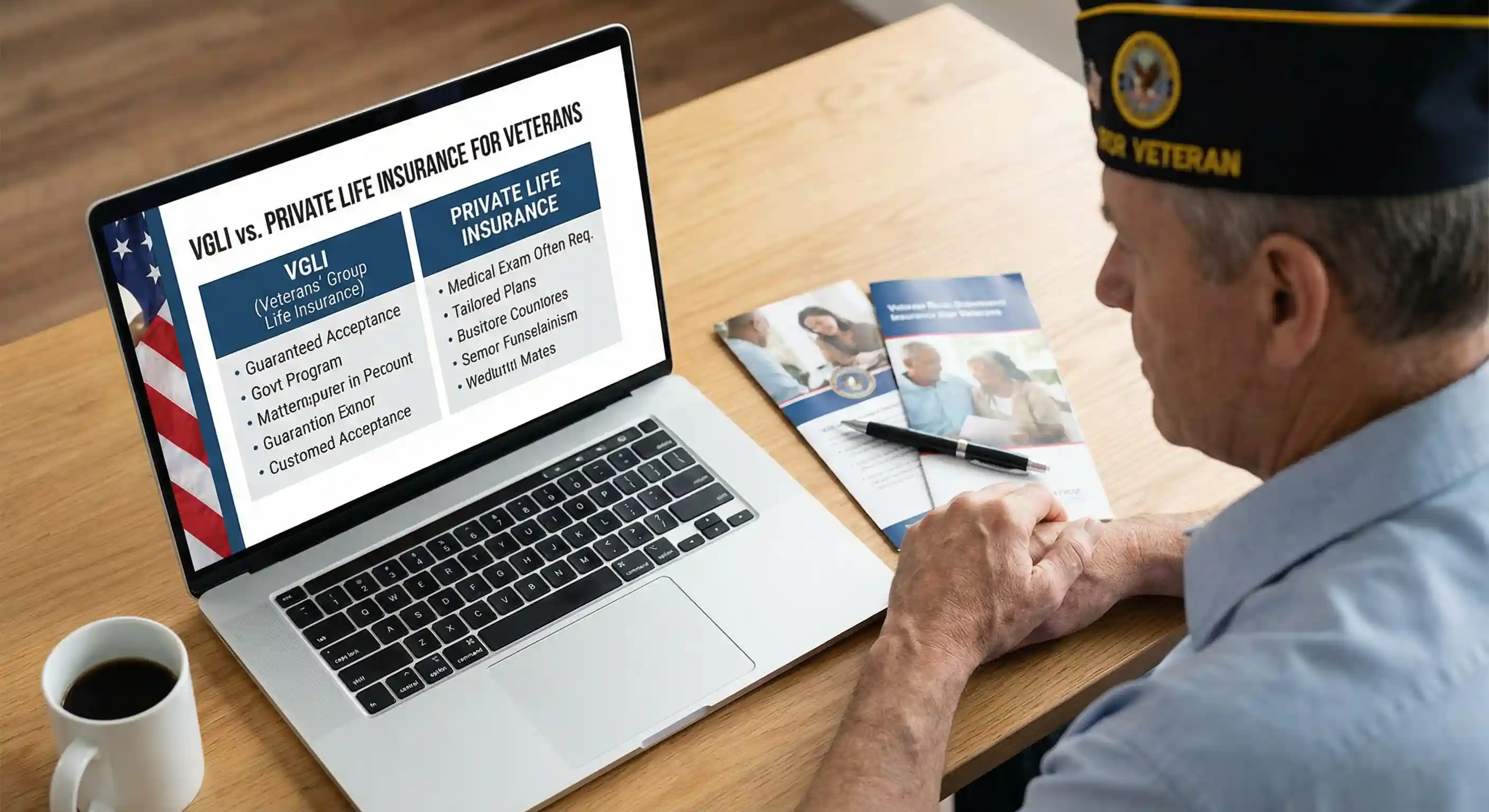

VGLI vs Private Life Insurance for Veterans Comparison: Making the Right Choice

The VGLI vs private life insurance for veterans comparison is something I walk through with almost every veteran I advise. There’s no one-size-fits-all answer, but understanding the trade-offs helps you make a smart decision for life insurance for retired military veterans.

When my daughter was born in 2020, I revisited my own coverage. I had my VGLI from separation, but I wondered if I was overpaying. After running the numbers for the VGLI vs private life insurance for veterans comparison, I discovered I could get a 20-year term policy for half the cost of my VGLI premiums. I kept $100,000 in VGLI as a backup and added $500,000 in private coverage. That’s the kind of strategic thinking that optimizes life insurance for retired military veterans.

VGLI vs Private Life Insurance for Veterans Comparison: Side by Side

| Factor | VGLI | Private Insurance |

|---|---|---|

| Medical Exam Required | No (within first 240 days) | Usually yes |

| Premium Structure | Increases every 5 years | Level for term length |

| Maximum Coverage | $500,000 | $1 million+ |

| Cost for Healthy 40-Year-Old | ~$80/month for $400K | ~$35-50/month for $500K |

| Cost for Veteran with Health Issues | Same as healthy veteran | Higher or declined |

| Portability | Always portable | Always portable |

| Conversion to Permanent | Can convert to commercial policy | Many policies include conversion |

When VGLI Wins the VGLI vs Private Life Insurance for Veterans Comparison

VGLI becomes the better choice when you have significant health issues that would result in high premiums or declination from private insurers. The National Association of Insurance Commissioners recommends veterans with pre-existing conditions carefully consider guaranteed-issue options like VGLI.

When Private Insurance Wins

If you’re under 50, in good health, and don’t smoke, private life insurance almost always offers better value in the VGLI vs private life insurance for veterans comparison. The level premiums mean you’ll pay the same amount for 20 or 30 years, while VGLI costs increase substantially as you age.

Pro Tip: Many savvy veterans combine both options—keeping some VGLI as guaranteed coverage while adding private term insurance for additional protection at lower rates. This layered approach optimizes life insurance for retired military veterans.

Burial and Final Expense Insurance for Military Veterans: Planning for the Inevitable

Discussing burial and final expense insurance for military veterans isn’t easy, but it’s an essential conversation. The average funeral in America now costs between $7,000 and $12,000, according to the National Funeral Directors Association. Even with VA burial benefits, there’s often a significant gap to cover.

When my father passed away in 2019—he was a Korean War veteran—the family scrambled to figure out burial costs despite his VA eligibility. We received the VA burial allowance, but it covered only a fraction of expenses. That experience taught me the importance of planning for burial and final expense insurance for military veterans before it’s needed.

Burial and Final Expense Insurance for Military Veterans: VA Burial Benefits

- Service-connected death burial allowance: Up to $2,000

- Non-service-connected burial allowance: Up to $948

- Plot allowance: Up to $948 if not buried in a national cemetery

- National cemetery burial: Free gravesite, opening/closing, headstone

- Presidential Memorial Certificate: Available to families

- Flag: Free burial flag for eligible veterans

Final Expense Insurance Options for Life Insurance for Retired Military Veterans

Beyond VA benefits, burial and final expense insurance for military veterans typically falls into two categories: guaranteed issue and simplified issue policies. The Insurance Information Institute provides detailed guidance on these options.

Final Expense Coverage Options for Veterans

- Guaranteed Issue: No health questions, higher premiums, 2-year waiting period—ideal for veterans with serious health issues

- Simplified Issue: Few health questions, no medical exam—moderate premiums for reasonably healthy veterans

- Traditional Whole Life: Medical exam required but lowest premiums for healthy veterans

- Pre-Need Funeral Insurance: Purchased directly through funeral homes, locks in today’s prices

When considering burial and final expense insurance for military veterans, remember that these smaller policies ($5,000-$25,000) serve a specific purpose: covering immediate expenses so your family doesn’t face financial stress during grief. They complement rather than replace comprehensive life insurance for retired military veterans.

For more on end-of-life planning, explore our detailed final expense insurance guide.

How to Choose the Right Life Insurance for Retired Military Veterans

Choosing the right life insurance for retired military veterans requires an honest assessment of your situation. Here’s the framework I use when advising fellow veterans:

Step-by-Step Guide to Choosing Life Insurance for Retired Military Veterans

- Calculate your needs: Consider debts, income replacement (10-12x annual income), education costs, and final expenses

- Assess your health honestly: Review your VA disability rating and current conditions

- Check your timeline: Are you within the SGLI to VGLI conversion window?

- Get multiple quotes: Compare VGLI, VALife (if eligible), and at least 3 private insurers

- Consider layering policies: Combine VA programs with private coverage for optimal protection

- Review beneficiary designations: Ensure they reflect your current wishes

- Schedule annual reviews: Life changes, and your coverage should adapt

When I sat down with my wife last year to review our own life insurance for retired military veterans strategy, we realized our needs had changed. The kids were older, the mortgage was smaller, and our retirement savings had grown. We actually reduced our coverage slightly while ensuring what remained was properly structured. Your coverage should evolve with your life.

For seniors looking at coverage options, our life insurance for seniors guide provides additional insights.

Frequently Asked Questions About Life Insurance for Retired Military Veterans

Can I have both VGLI and private life insurance?

Absolutely. Many veterans maintain VGLI alongside private policies. There’s no limit to how many life insurance policies you can hold—just what you can afford and what you can qualify for. This is often the smartest approach to life insurance for retired military veterans.

I missed the VGLI deadline. What are my options?

If you have a service-connected disability, VALife offers guaranteed acceptance regardless of when you separated. Otherwise, you’ll need to pursue private insurance with medical underwriting. Working with an independent agent who specializes in veteran coverage can help find insurers most likely to offer favorable rates.

Does my VA disability rating affect VGLI or VALife premiums?

No. Both VGLI and VALife premiums are based solely on age, not health status or disability rating. This is one of the greatest advantages of VA life insurance programs for veterans with service-connected conditions.

Is life insurance through USAA good for veterans?

USAA offers competitive rates and understands military life, making them a solid choice for life insurance for retired military veterans. However, they’re not always the cheapest option—always compare multiple quotes. Their customer service and understanding of veteran needs is exceptional.

How much life insurance do retired veterans need?

The standard recommendation is 10-12 times your annual income, but this varies based on your pension, SBP enrollment, debts, and family situation. A veteran with a full retirement pension and SBP may need less than someone who retired early with minimal benefits. Consider all income sources when calculating your needs.

Can my spouse keep my VGLI if I pass away?

VGLI pays your designated beneficiary (typically your spouse) a lump sum death benefit. Your spouse cannot continue the VGLI policy after your death—it terminates. However, they receive the full face value of the policy tax-free, which is the policy’s purpose.

Taking Action to Protect Your Family

Navigating life insurance for retired military veterans doesn’t have to be overwhelming. You served your country with dedication—now it’s time to ensure your family is protected with the same level of commitment.

I think back to that phone call from Steve years ago and how close he came to missing his VGLI window. Today, he’s properly covered, his family is protected, and he’s helping other veterans in his VFW post understand their options. That’s the ripple effect of good information.

Whether you’re fresh out of the military or you’ve been retired for decades, there’s an option for life insurance for retired military veterans that fits your situation. Start with an honest assessment of your health, your finances, and your family’s needs. Then take action—because your loved ones are counting on you, even after you’re gone.

Ready to Secure Your Family’s Future?

Don’t wait until it’s too late. Review your life insurance for retired military veterans options today and give your family the peace of mind they deserve. Your service protected our nation—now protect what matters most to you.

About the Author

Michael Thompson is a licensed insurance advisor and U.S. Army veteran who served 22 years including deployments to Iraq and Afghanistan. After retiring as a First Sergeant in 2018, he obtained his insurance licenses specifically to help fellow veterans navigate the complex world of life insurance.

Based in San Antonio, Texas, Michael works with veterans nationwide to find the right coverage for their unique situations. He is a member of the National Association of Insurance and Financial Advisors (NAIFA) and volunteers with several veteran service organizations.

Connect with Michael on LinkedIn or visit the VA Life Insurance Center for official program information.

Life Insurance for Retired Military Veterans: Action Checklist

- Check your SGLI to VGLI conversion deadline (1 year and 120 days from separation)

- Review your VA disability rating for VALife eligibility

- Calculate your total coverage needs (income replacement, debts, education, final expenses)

- Get quotes from VGLI, VALife (if eligible), and at least 3 private insurers

- Consider combining VA programs with private coverage for optimal protection

- Update beneficiary designations on all existing policies

- Schedule an annual insurance review to ensure coverage matches your needs