Updated: January 24, 2025 | by Emily Carter, Licensed Insurance Agent & Pet Owner | Reading Time: 17 minutes

Quick Answer: The most reliable way to get cheap pet insurance for multiple pets discount in the U.S. is to put all of your dogs and cats on the same account with a carrier that offers a true multi-pet discount (typically 5–10% off each additional pet) and then customize coverage with higher deductibles and lower reimbursement for younger, healthier animals. According to the North American Pet Health Insurance Association (NAPHIA), U.S. pet insurance enrollment grew over 20% last year, and multi-pet policies are one of the fastest-growing segments as families try to control costs without sacrificing protection.

Why Multi-Pet Insurance Became Personal for Me

When I adopted my second rescue dog, Daisy, I naively thought, “How much more expensive can a second pet really be?” I already had coverage on my older dog, Max, and I assumed adding Daisy would be just a few extra dollars a month. I was wrong—at least, before I learned how cheap pet insurance for multiple pets discount actually works.

The moment that really shook me happened on a rainy Thursday in Denver. Max tore his cruciate ligament chasing a ball at the park. The emergency vet bill for surgery and rehab was just under $4,800. The only reason I didn’t have a full meltdown in the parking lot was that his insurance picked up almost 80% after the deductible. Two months later, Daisy swallowed part of a rope toy and needed an endoscopy. That bill? Another $2,100.

That year, I spent more on veterinary care than I used to spend on my car loan. But because I had both dogs insured under a multi-pet plan, my premium was about 8% lower than if I had insured them separately. That discount alone covered nearly one full month of premiums every year. It wasn’t magic—just understanding how insurers structure affordable multi-pet insurance and how to stack the right discounts.

Now, as a licensed insurance agent, most of my pet insurance clients in the U.S. have more than one animal—two siblings from the same litter, a senior cat plus a new puppy, or an entire “starter pack” of rescues. They all ask the same question: “Is there a way to make this cheaper if I insure everyone together?” This guide is my detailed answer.

For a broader foundation on protecting your animals, start with our beginner’s guide to pet insurance.

Cheap Pet Insurance for Multiple Pets Discount: Why It Matters in 2025

Veterinary care in the U.S. is getting more expensive every year. According to the ASPCA, routine vet care for a dog averages $300–$500 per year, but emergency surgery can easily cross $5,000. Multiply that by two, three, or four pets and you’re suddenly one accident away from serious credit card debt.

That’s why cheap pet insurance for multiple pets discount is more than a nice-to-have—it can be the difference between being able to say “yes” to treatment or having to ask your vet what the absolute minimum they can do is. Families with multiple animals face a higher cumulative risk: if one pet gets through the year healthy, another might not. A multi-pet plan smooths that risk and distributes cost in a manageable way.

How Cheap Pet Insurance for Multiple Pets Discount Is Usually Structured

- First pet pays full price: The base rate is set by age, breed, and location.

- Additional pets get a discount: Often 5–10% off the premium, sometimes more if you insure three or more pets.

- Shared account, separate policies: Each pet still has its own deductible and coverage, but the billing and discount are grouped.

- Other stackable discounts: Many insurers allow you to combine multi-pet savings with autopay, military, or annual-pay discounts.

The American Veterinary Medical Association (AVMA) notes that pet insurance is most effective when purchased before a major illness appears, especially for breeds prone to expensive conditions like hip dysplasia or heart disease. If you have several pets, the odds that one will need advanced care in any given year are simply higher, which makes multi-pet coverage and discounts particularly valuable.

Affordable Multi-Pet Insurance: How Pricing Actually Works

When people hear “affordable multi-pet insurance,” they often imagine some kind of family plan where all pets share one big deductible. In reality, most U.S. insurers price each pet separately—then apply the multi-pet discount to the base premiums. Understanding this helps you customize coverage to create your own version of cheap pet insurance for multiple pets discount.

Key Pricing Factors in Affordable Multi-Pet Insurance

| Factor | Impact on Premium | How to Control Cost |

|---|---|---|

| Species & breed | Large dog breeds cost more than cats; brachycephalic (flat-faced) breeds are pricier. | Mix higher-risk pets with lower-cost pets on the same account to maximize multi-pet discounts. |

| Age of each pet | Premiums rise as pets age; seniors are significantly pricier. | Enroll pets when they are young to lock in lower starting premiums. |

| Coverage type | Accident-only is the cheapest; accident + illness is standard; wellness add-ons raise cost. | Use accident-only for very young, healthy pets if budget is tight. |

| Deductible & reimbursement | Higher deductibles and lower reimbursement percentages reduce premiums. | Choose richer coverage for older or high-risk pets, leaner coverage for low-risk pets. |

| Location (ZIP code) | Urban areas with higher vet costs mean higher premiums. | Shop around—different insurers weigh regions differently. |

According to data analyzed by NerdWallet, average monthly pet insurance premiums in the U.S. range from about $20–$30 for cats to $40–$70 for dogs, depending on coverage. With affordable multi-pet insurance, you’re not changing how each pet is rated—you’re trimming the final price with multi-pet insurance savings and smarter plan design.

If you want a deeper dive into pricing beyond multi-pet plans, see our article on how much pet insurance really costs.

Multi-Pet Insurance Savings and Discounted Pet Coverage Explained

When you’re shopping for discounted pet coverage, the phrase “multi-pet discount” can mean slightly different things depending on the company. Some carriers give a flat 5–10% off each additional pet; others only discount pets three and up, or cap the total discount amount per household.

Typical Multi-Pet Insurance Savings in the U.S.

- 5% discount on the second pet and beyond (common baseline).

- 10% discount for three or more pets with some carriers.

- Additional 5–10% for autopay, paying annually, or being a military or veteran household.

- Occasional promotional codes that stack with multi-pet insurance savings for new customers.

How to Turn Discounts Into Truly Cheap Pet Insurance for Multiple Pets Discount

If your goal is genuine cheap pet insurance for multiple pets discount, you need to combine percentages and plan design. For example, a client of mine in Phoenix insured three indoor cats with the same carrier. Individually, their plans would have cost about $28 per month each. By:

- Choosing a $500 deductible instead of $250,

- Selecting 70% reimbursement instead of 90%,

- Paying annually, and

- Using the 10% multi-pet discount,

we brought the total for all three cats down to just under $60 per month. That’s the kind of multi-pet insurance savings that actually moves the needle for a middle-class household.

Cheap Pet Insurance for Multiple Pets Discount Mistakes to Avoid

The biggest trap I see is pet parents fixating only on the discount percentage. A 10% discount on an overly rich plan that you can’t afford long term isn’t a good deal. Make sure you:

- Don’t add pricey wellness riders for every pet if your budget is tight.

- Don’t assume the same annual limit makes sense for a 2-year-old cat and a 12-year-old German Shepherd.

- Don’t forget to factor in how premiums will rise as pets age.

Best Pet Insurance Deals and Low-Cost Insurance for Pets

When people search for the best pet insurance deals, they’re usually balancing three things: monthly price, coverage quality, and how simple the claims process is. Adding multiple pets makes that balancing act trickier—but also opens the door to better discounts that turn solid coverage into truly low-cost insurance for pets.

Best Pet Insurance Deals: What to Look For

| Feature | Why It Matters | What to Aim For |

|---|---|---|

| Multi-pet discount percentage | Directly reduces premium on each additional pet. | 5–10% per additional pet, ideally with no cap on number of pets. |

| Annual limits & sub-limits | Prevents “gotcha” moments when you think you’re covered but hit a cap. | At least $10,000 annual limit or unlimited for higher-risk pets. |

| Reimbursement method | Determines how much you get back after deductible. | Clear percentage of the vet bill (e.g., 70–90%). |

| Waiting periods & pre-existing rules | Affects when coverage starts and what conditions are excluded. | Short waiting periods and transparent pre-existing definitions. |

| Customer reviews & claims reputation | Great coverage means little if claims are denied or delayed. | Strong ratings on independent sites and fast reimbursement times. |

Third-party reviewers like Consumer Reports emphasize that pet insurance is especially compelling when you have multiple pets and want to cap your worst-case scenario. The trick is picking a policy where those best pet insurance deals are legitimate cost savings and not just marketing language.

For company-by-company breakdowns, visit our roundup of the best pet insurance companies in 2025.

How to Compare Cheap Pet Insurance for Multiple Pets Discount Plans

Comparing plans for a single pet is already a chore. When you’re trying to optimize cheap pet insurance for multiple pets discount across three or four animals, it can feel overwhelming. The key is to standardize what you’re comparing so you’re not tricked by teaser rates or incomplete quotes.

Step-by-Step Comparison Checklist for Multi-Pet Insurance Savings

- Step 1 – Make a pet profile sheet: List each pet’s age, breed, weight, and known conditions.

- Step 2 – Decide your “must-have” coverage: Accident + illness for all? Wellness only for one senior dog?

- Step 3 – Pick a test plan design: For example, $500 deductible, 80% reimbursement, $15,000 annual limit for each pet.

- Step 4 – Get at least three quotes: Use identical test plan settings when possible so you can see which carrier truly offers cheaper multi-pet pricing.

- Step 5 – Note the multi-pet discount separately: Ask what your rate would be for each pet alone, then with all pets together, so you see the real multi-pet insurance savings.

- Step 6 – Review exclusions and waiting periods: Especially for knee injuries, hip dysplasia, and hereditary issues.

- Step 7 – Check fine print on renewals: Some companies won’t raise rates for individual claims, others will; this matters a lot when you have multiple pets.

One pro tip: if you’re comparing quotes online, take screenshots. Several of my clients have come back to me months later, confused because their renewal looked nothing like the teaser quote they remembered. Having evidence of the original discounted pet coverage terms gives you leverage if you need to call and negotiate or switch carriers.

For a deeper how-to on comparison shopping, read our guide on how to compare pet insurance quotes the right way.

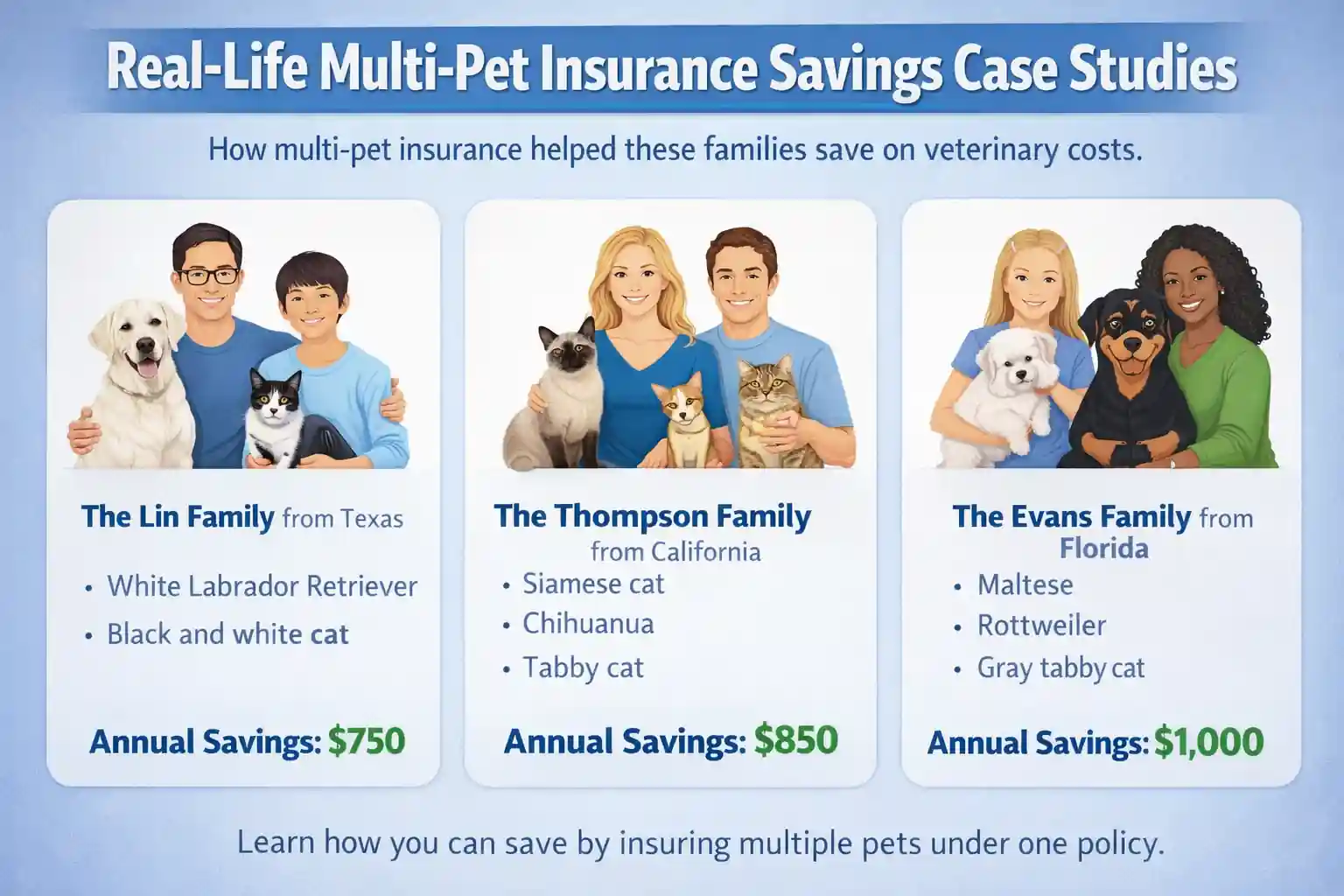

Real-Life Multi-Pet Insurance Savings Case Studies

Numbers on a page are one thing. Seeing how cheap pet insurance for multiple pets discount plays out in real households is another. Here are a few examples from my clients (with names and small details changed for privacy) across the United States.

Case Study 1: Two Dogs in Texas – Accident-Heavy Lifestyle

“Jake” and “Buddy” live with their family just outside Austin. Jake is a 4-year-old Labrador with a habit of eating socks; Buddy is a 2-year-old mixed breed who loves agility courses. Their owners originally had no insurance and paid a $2,700 emergency vet bill out of pocket when Jake ate a corn cob and needed surgery.

After that scare, we set them up with a plan designed around low-cost insurance for pets rather than every bell and whistle:

- $750 deductible per pet

- 70% reimbursement

- $15,000 annual limit

- Accident + illness (no wellness add-on)

- 10% multi-pet discount + 5% autopay discount

Combined, their premium came to about $63 per month. Without the multi-pet discount, it would have been roughly $71. When Buddy later tore a ligament requiring $3,200 in treatment, the insurance reimbursed about $1,715 after the deductible—more than covering several years of net premiums.

Case Study 2: Three Indoor Cats in New York – Budget-Conscious Owner

A client in Brooklyn adopted a bonded pair of adult cats, then added a kitten six months later. As a freelance designer, her income fluctuates—a bit like when I rented a car in Italy one summer and had to weigh the cost of the extra rental insurance against my thin travel budget. She wanted peace of mind, but her monthly budget was tight.

We focused on affordable multi-pet insurance rather than top-tier coverage:

- Accident + illness for all three cats

- $500 deductible, 80% reimbursement

- $10,000 annual limit per cat

- 10% multi-pet insurance savings for three pets + online sign-up discount

Her total monthly cost: just under $58 for all three cats. A single hospitalization for a urinary blockage (which can easily cost $1,500–$2,000) would justify years of premiums, and she sleeps easier knowing a series of unexpected vet visits won’t derail her rent payments.

Cheap Pet Insurance for Multiple Pets Discount vs. Self-Insuring

Some pet owners prefer to “self-insure” by setting money aside in a savings account. This can work—if you’re disciplined, start early, and your pets stay relatively healthy. But when you have three or four animals, the math can get lopsided quickly. A single year with two major surgeries can wipe out several years of careful saving.

Comparing Self-Insurance vs. Multi-Pet Insurance Savings

| Scenario | Self-Insurance Only | With Cheap Multi-Pet Insurance |

|---|---|---|

| Monthly contribution / premium | $80 into savings account | $70 premium for 3 pets (after discount) |

| Total set aside over 5 years | $4,800 (if you never miss a month) | $4,200 in total premiums |

| Unexpected surgeries (2 pets) | $9,000 out of pocket; savings covers only half. | Insurance reimburses 70–80%; out-of-pocket closer to $3,000 total. |

For larger families of pets, cheap pet insurance for multiple pets discount is essentially buying a cap on your worst-case scenario. Self-insuring alone can work for some people, but for many U.S. households, especially with kids and mortgages, that risk is hard to stomach.

To understand how other types of coverage protect you from catastrophic expenses, see our piece on handling emergency vet bills and financing options.

Multi-Pet Insurance Dos and Don’ts for Maximum Savings

After a decade of helping families find cheap pet insurance for multiple pets discount solutions, I see the same patterns over and over. Avoiding a few common mistakes can save you hundreds of dollars and a lot of frustration.

Multi-Pet Insurance Savings: Key Dos

- Do enroll pets when they’re young to avoid pre-existing exclusions.

- Do put all pets with the same carrier to unlock the full multi-pet insurance savings.

- Do adjust coverage pet-by-pet based on age and breed risk.

- Do ask explicitly about stackable discounts (multi-pet + annual pay + autopay).

- Do read the sample policy before signing—especially hereditary condition coverage.

Discounted Pet Coverage: Important Don’ts

- Don’t assume the cheapest intro rate will stay cheap at renewal.

- Don’t buy wellness add-ons for every pet if it breaks your budget—stick to core coverage.

- Don’t wait until after a diagnosis to try to buy coverage; that condition will be excluded.

- Don’t cancel a long-standing policy without understanding how starting new coverage at an older age will change premiums.

- Don’t rely solely on marketing blurbs—use independent sources like the National Association of Insurance Commissioners (NAIC) for unbiased information.

For more on policy fine print and exclusions, especially for chronic conditions, read our guide to pet insurance and pre-existing conditions.

Frequently Asked Questions

Is it cheaper to insure two pets instead of one?

Per pet, yes—if the company offers a multi-pet discount. Your total monthly bill will be higher with two pets than one, but the cheap pet insurance for multiple pets discount means each pet costs slightly less than if they were insured alone. The more pets you add (within reason), the more meaningful the discount becomes.

Can I get affordable multi-pet insurance if one pet has a pre-existing condition?

Usually, yes—but the pre-existing condition itself will not be covered for that pet. Your other pets can still receive full coverage, and all of them can be on the same account benefiting from the multi-pet discount. This is where it’s crucial to read each carrier’s pre-existing language carefully.

Do multi-pet insurance savings apply to wellness plans too?

Sometimes. Some insurers apply the discount to the entire package (core coverage + wellness riders), while others only discount the accident and illness portion. If you’re adding wellness for vaccines and checkups, ask the company specifically whether the multi-pet discount applies to that segment of the premium.

Can I switch pet insurance carriers and keep my multi-pet discount?

You can switch carriers at renewal or mid-term (depending on company rules) and get a new multi-pet discount with the new insurer. However, any conditions diagnosed before the new policy’s effective date will be considered pre-existing and excluded. That’s why switching for a slightly better discount is risky if one of your pets has already developed chronic issues.

How many pets can I insure on one discounted pet coverage account?

This varies by company. Many major carriers allow 5–10 pets per household on one account, all eligible for the multi-pet discount. If you run a small rescue or foster multiple animals, ask whether there is a maximum number of pets eligible for the discount and whether they must all live at the same primary address.

Final Thoughts: Making Cheap Pet Insurance for Multiple Pets Discount Work for You

If you’ve read this far, you’re clearly serious about protecting your furry family while keeping your budget under control. That’s exactly what cheap pet insurance for multiple pets discount is designed to do—turn unpredictable, potentially devastating vet bills into a predictable monthly line item you can actually plan for.

The goal isn’t to find the absolute rock-bottom premium; it’s to find the sweet spot where coverage is strong enough to matter when something big happens, and discounts like affordable multi-pet insurance and autopay savings keep the cost reasonable month after month. If you take nothing else from this guide, remember:

- Insure pets while they’re still healthy.

- Put them all on the same account to unlock the best pet insurance deals.

- Customize coverage per pet; not everyone needs the same limits.

- Stack multi-pet, autopay, and annual-pay discounts to create your own discounted pet coverage package.

For related reading, you may also find these helpful:

pet liability coverage explained,

travel insurance when you bring pets along, and our

guide to paying unexpected vet bills.

Ready to Find Your Multi-Pet Insurance Savings?

Take 10 minutes to list your pets, decide your must-have coverage, and collect three quotes using the same plan settings. You’ll be surprised how much you can save when you combine smart plan design with a solid cheap pet insurance for multiple pets discount.

About the Author

Emily Carter is a licensed insurance agent and lifelong animal lover based in Denver, Colorado. She specializes in pet, home, and renters insurance, with a focus on helping multi-pet households find coverage that fits real-world budgets. Emily shares her home with two rescue dogs and one very opinionated gray cat.

After seeing clients drain their savings on preventable vet bills, Emily became passionate about explaining pet insurance in plain English. She contributes regularly to USCoverMe on topics like multi-pet insurance, emergency vet planning, and how to integrate pet coverage into a broader financial safety net.

Connect with Emily on LinkedIn and explore official guidance on pet insurance from the American Veterinary Medical Association.

“`